unemployment tax refund when will we get it

Your tax return has errors. The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits.

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

A quick update on irs unemployment tax refunds today.

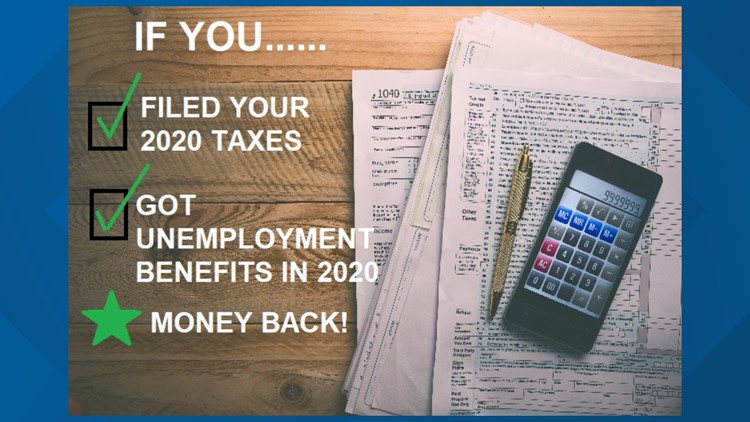

. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. Depending on whether you fall into the first or second wave. This is the fourth round of refunds related to the unemployment compensation.

What Are the Unemployment Refunds. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. The tax rate for a start-up entrepreneur is 10 for the first year of liability 11 for the second year of liability and 12.

Refunds to start in May. Lets say one spouse collected 5000 in. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

Heres a list of reasons your income tax refund might be delayed. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

The most recent batch of unemployment refunds went out in late july 2021. The IRS has sent 87 million unemployment compensation refunds so far. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a.

Tax refunds on unemployment benefits to start in May. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. Here is more information about unemployment tax.

In a nutshell if you received unemployment benefits in 2020 and paid taxes on that money. Unemployment compensation is intended to provide benefits to employees who lose their jobs through no fault of their own. They can use the Get Transcript tool on IRSgov.

Refunds are expected to begin in May. You filed for the earned income tax credit or additional child tax credit. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

The Internal Revenue Service has sent 430000 refunds. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020. I filed my taxes for 2020 before Congress passed the new act stating 10200 of unemployment would be non-taxable.

22 2022 Published 742 am. Will I get a tax refund from unemployment. Taxpayers can use Get Transcript by Mail or call 800-908-9946 to.

The amount of the refund will vary per person depending on overall. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Here is more information about unemployment.

According to the Internal Revenue Service there is indeed life. If I Paid Taxes On Unemployment Benefits Will I Get A Refund. I received my refund original in March.

By Anuradha Garg. The agency has confirmed that it will issue the refunds automatically to US. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

To get a transcript taxpayers can. IRS will issue refunds on up 10200 in unemployment benefits.

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

When Will Irs Send Unemployment Tax Refunds 10tv Com

Here S How To Get Your Unemployment Tax Refund Irs Says Payments Coming In May Silive Com

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Year End Tax Information Applicants Unemployment Insurance Minnesota

Interesting Update On The Unemployment Refund R Irs

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More Brinker Simpson

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/F7BIELZCJJGPJAHTTTAMMEQ24E.png)

Asked And Answered Filing Taxes While On Unemployment

/cloudfront-us-east-1.images.arcpublishing.com/gray/4MOYBEDSEFCGTJHUEM73A3QU3Y.jpg)

Irs Issues Another Round Of Refunds To 1 5 Million Taxpayers Who Overpaid Taxes On Unemployment

Filed Taxes And Missed The 10 200 Unemployment Exclusion Don T Amend Your Return

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Irs Is Sending Unemployment Tax Refund Checks This Week Money

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor